COMMON SENSE ON MUTUAL FUNDS BY JOHN BOGLE SUMMARY

Take-Aways

· Start investing as soon as possible. And never stop.

· Use mutual funds to decrease risk via diversification.

· Fund cost could be the sole crucial factor in deciding your return.

· Actively managed funds don’t do as well as index funds.

· Bonds can give steady income to the portfolio. Low-cost index funds are the lowest on risk and maximum-return ways for bond investment.

· There’s no need for American investors to invest internationally. Instead, they can get global exposure through a diverse portfolio of American firms. For example, S&P 500.

· From 1960 to 1997, the S&P500 received same returns as the EAFE. EAFE stands for Europe, Australia, and Far East Index.

· Asian and European funds perform well, but just due to currency risk.

· The investment management sector is drifting from its responsibilities of a trustee.

· Today, mutual funds are more about marketing and not about strong financial management.

Revolutionary Common Sense

Common sense, as per the Oxford English Dictionary, is natural intelligence held by rational beings. Sadly, this common sense is not very common. But, to be a sound investor, you should apply common sense continuously. That is, in your choice of investment, strategy, and performance.

Your primary principle must be a growth in the long-term. Regardless of where you put your money in, there’s always some risk. Be it bonds, stocks or real-estate. Being an investor, you should have a balance between return and risk. Because everyone’s tolerance to risk is different. And, so is the appetite for return. Such a balance always varies from person to person.

“NO MATTER WHAT THE FUTURE HOLDS, LONG-TERM INVESTORS WHO HAVE CHOSEN AN INDEX STRATEGY BECAUSE OF ITS MERITS ARE UNLIKELY TO BE DISAPPOINTED.”

Allocating Your Assets

Allocation of assets is the most critical investment decision. Much of the return from a portfolio is due to wise asset allocation. Hence, take a disciplined approach to this. But, also keep an eye on the long-run. This will dramatically improve your chance of attaining your investment goals.

If you’re investing in mutual funds, you aren’t choosing individual options. Instead, your primary choice is which fund to acquire from the thousands. Most investors stick to the Holy Grail. That is, picking the fund which offers remarkable returns in the long-run. Knowing this, the mutual fund sector keenly promotes stars. Advertisements highlighting market-beating funds often twist the reality of mutual fund investing.

In reality, few fund managers outdo the market in a given time. And, those who do surpass it for the time being, hardly keep-up the record. Market-beating performance of long-term is hard to hear. Predicting which fund managers will outdo the market is impossible.

Historical performance doesn’t ensure similar outcomes in the future. Excellent past performance provides an average or even poor future results. This isn’t anything to do with the investment managers. Instead, it’s got all to do with statistics. In the long run, performance reverts to the mean. Hence, a fund which had remarkable returns regresses to the mean after a period of low returns.

Motivated by Marketing

Why doesn’t the mutual fund sector tell this to its investors? Maybe, at one time, the fund managers did explain it. But, the mutual fund industry has shifted from its base. That is strong principles of service and trust. Marketing has taken the place of management. Financial companies in the mutual fund industry don’t act like trusted advisors now. Instead, they work like consumer product firms. They bring those fund products which investors want. Then they test them in labs to check if they’ll be hit. These firms know that funds can’t sustain high-performance in long-run. But, still, they endorse the excellent results of small funds. Also, they don’t close their funds to new investors. This, knowing that funds have become too massive to produce desirable returns. Good counsel no longer exists.

Plus, mutual fund governance has some severe issues. The delegation of operational authority to outside management firms is especially troublesome. It’s high time; the mutual fund industry reorganized to become more useful and more straightforward. The goals must be to serve investors.

Now, the mutual fund sector looks like a closed, manipulative union. It gives the impression of a government which levies taxes without representation. There is a need to shake up the mutual fund industry. With the involvement of their Directors, fund managers take high charges for managing funds. But, once they get the money, they manage funds as per their interests. And not on behalf of the owners. Hence, it high-time the investors demanded change. If they don’t get the desired change, they should invest elsewhere.

The Market Always Rises – But Beware of Individual Managers

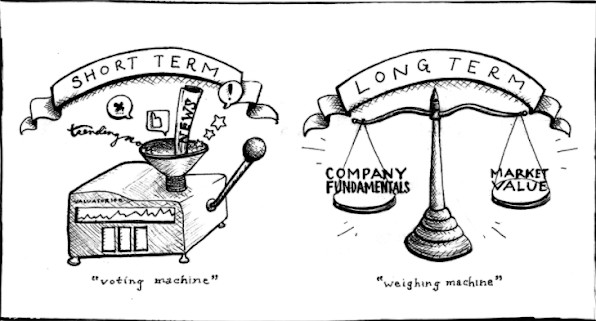

Two historical forces are responsible for the U.S. bond and stock markets’ performance. Firstly, the market fundamentals, like yields, earnings, and dividends. Secondly, trading or speculation which shows emotion about the market.

Investors entrust their active managers to invest where the return is maximum. Their belief in the market fluctuates. But, overall, it’s been quite durable. It survived wars, depression, boom, bubble, and bursts. The faith of investors often got well received. Share market investors did better than bond investors. Short-term investors might suffer due to market instability. But, in the long-run, a stock’s fluctuation falls. In simple terms, the higher the holding period, the lesser the volatility.

Ironically, returns from bonds are inconsistent relative to equities. The most significant risk for investors in American government bonds is inflation. In contrast, corporate bonds and bonds of emerging markets have substantial credit risks.

The stock market has been favorable for all, in general. Still, individual stock selectors don’t do as well as the whole market. Economists have shown that fund manager can’t beat the stock-market in long-run. Those who beat the market one period, lose in the next. Plus, investors who use services of managers, pay dearly for a doubtful performance. Management fees can take a toll on their returns.

The Most Cost-Effective Approach

The smartest way to reduce cost while investing is to get rid of the managers. Instead, buy a representative cross-segment of the whole market. The passive investors never outdo the market. But, they’re also never left behind. Plus, they pay lower expenses and fees. Consider this:

The most cost-effective approach to investing is to dispense with the active manager and buy a representative cross-section of the entire market. So-called passive investors never beat the market. But they never lag behind it, either. Moreover, they pay lower management fees and expenses than investors who “hire” active managers. Consider this:

1. The sum of passive and active total returns is equal to the market’s total return.

2. Active investors incur higher costs than passive ones.

3. Hence, passive investors get higher returns.

“MARKET TIMING AND RAPID TURNOVER – BOTH BY AND FOR MUTUAL FUND INVESTORS – BETRAY BOTH A LACK OF UNDERSTANDING OF THE ECONOMICS OF INVESTING AND AN INFATUATION WITH THE PROCESS OF INVESTING.”

Minimize Your Risk

Most investors should consider just three asset groups:

· Stocks – To increase returns.

· Bonds – To produce income.

· Cash – To decrease risk and stabilize principal.

The risk is the only critical factor in an investment tactic. You should determine how to balance return and risk. High return means high risk and vice versa. As an investor, you may have risky assets in your portfolio. But, you should also have other assets which balance this risk. Suppose the bond and stock markets go in opposite directions. Now, you can decrease your risk while increasing the portfolio returns. How? By holding both bonds and stocks. Only holding bonds will open you to risk of an unfavorable market. Holding only shares will open you to the threat of a bear market. But, holding both offers a chance to enjoy the ups of each market. Also, you’re safe from the downside of both.

Remember that this discussion applies to the whole market. Not to individual bonds or stocks. Your returns rely on your choice of asset allocation. Hence, assign your assets remembering the long-term goals. Also, don’t forget to rebalance your portfolio from time-to-time.

Take Costs into Account

Costs are important. In the mutual fund business, costs differ significantly from fund to fund. Always remember that the compounding magic also applies to cost. As a basic rule:

· Reduce expenses by checking funds as per expense ratios.

· Outside advice is expensive and doesn’t bring much value. So, no-load funds are ideal.

· See past performance with a pinch of salt.

· Look at earlier performance keeping an eye only on risk and returns.

· Stars do fall. Reverting to mean is a fixed law of the market.

· Be cautious of significant funds. As funds get larger, high performance becomes vaguer.

· Only invest in a few funds. Or else, you’ll become a closet indexer. This means you’ll end up giving high fees of owning many funds. But, your total exposure will only be close to an index fund.

· Hold your funds after buying.

The Index Fund Advantage

Index funds must form the base of your portfolio. Active managers can’t outdo the market in the long-term. Plus, nobody can find few exceptions of this rule in advance. The 1st index fund was an S&P500 because it was a standardized index. This index was well-organized and denoted 90% of the stock market capitalization.

It now denotes just three-quarters of the stock market’s capitalization. If you wish to own the market, then buy the Wilshire 5000 Equity Index. However, in the long run, both S&P500 and Wilshire will produce similar returns. Indexing is useful in all markets. Even in some inefficient ones, its cost benefits make it an excellent choice.

Index bonds are as good as index equity funds. It doesn’t make any sense to pay an active manager to pick bonds. Investment in index bonds enables you to diversify widely. Also, you can reduce your risk significantly without compromising on returns. Most index bond funds help you target the maturities. Plus, you can purchase and sell small quantities of stocks. But, these funds often cost more than such benefits are worth. Cost is more crucial in bond investments than in stocks. It doesn’t make any sense to pay a hefty fee for a bond fund.

“SPECULATION IS TYPICALLY THE ONLY REASON FOR THE SOMETIMES ASTONISHING DAILY, WEEKLY OR MONTHLY SWINGS WE WITNESS.”

There’s No Place Like Home

Traditional wisdom says that investors must diversify worldwide. The reason for such diversification is that global markets don’t relate with American markets. Going by the books, such diversification must decrease your portfolio’s instability. Besides, it should also raise your risk-adjusted returns. But, there’re severe questions if this theoretical idea holds true in practice.

Plus, investing globally means you’ll be taking currency risk. The high returns which global investors earn in short-run may be because of currency risk. But, in long-term, currency risk returns to the mean. Hence, it removes any investment benefit. The EAFE Index gave the same return of 11.5% as the S&P500 from 1960-1997.

U.S. investors shouldn’t invest anywhere but, in the U.S. The U.S. has the highest productivity in the world. It leads the world regarding innovation rate. Plus, it has the most investor-friendly law system besides the highly efficient markets. Even if you don’t invest in global funds, you can engage in global growth. If you have the S&P500, you hold an international portfolio. How? Because firms in the S&p500 get nearly 23% of their revenue from non-American sources.

Common Sense on Mutual Funds Review

Common sense is said to be the key to the effective investment in any of the industry. The person does not need to have some exceptional education to know about the tactics of the investments, but with the help of common sense and a little knowledge of the trends and market of the industry, one can make excellent investments. There are a lot of markets in which the investment can be made, but it is imperative for the person to know the best kind of investment for his assets. The choice of investment is likely to play the primary role in the profit-making and the return on the investment.

There are said to be some of the Approaches to investing in mutual funds in the investment. For the better allocation of all of the assets it is critical for the investor to keep an eye on the long-term profit, it might take some time, but in the more extended run, I have a lot of benefits for the investor. Although it is challenging for the person to know that which is investment that in the long run likely to beat the market and provide the maximum return. The marketing must motivate the mutual funds. There are short term and long term investors in the market that have to keep in mind the market inflation form investing.

For the better investment, the Tolerance of risks must be very high. The assets must be allocated in the right place, and there are said to be a lot of reform of the mutual funds that are needed to be made in case of the investment. So we can say that the effective way of investing is to give out with the active manager and purchase a delegate cross-section of the whole market. The passive investors not at all strike the market.

Common Sense on Mutual Funds Quotes

“Investing is an act of faith, a willingness to postpone present consumption and save for the future.”

“No matter what the future holds, long-term investors who have chosen an index strategy because of its merits are unlikely to be disappointed.”

“Market timing and rapid turnover – both by and for mutual fund investors – betray both a lack of understanding of the economics of investing and an infatuation with the process of investing.”

“Speculation is typically the only reason for the sometimes astonishing daily, weekly or monthly swings we witness.”

“Reversion to the mean represents the operation of a kind of ’law of gravity’ in the stock market, through which returns mysteriously seem to be drawn to norms of one kind or another over time.”

“The choice of equity fund styles – like the choice of fund portfolio managers – is just one more example of industry witchcraft.”

“Active managers [fail], on average, to outperform appropriate market indexes, even before costs are deducted.”

“If small is beautiful, mutual funds are not as pretty as they once were.”

“We have moved this industry away from our guiding principles to new principles that ill-serve fund investors. No longer is the prudent, disciplined stewardship of fund portfolios the core function around which all others are satellite.”

“Demand that the industry provide you with mutual funds that measure up to a high level of trusteeship responsibility. You deserve it.”

“The records of funds that invest in Europe clearly validate the index approach to international investing.”

“Stay home and dig in your own garden, instead of tempting fate in an alien world. You will find ’acres of diamonds’ right where you are.”

AUTHOR

ANKIT VERMA

ASSISTANT PROFESSOR

Comments

Post a Comment