Irrational Exuberance By Robert shiller

CHAPTER 1: THE STOCK MARKET LEVEL IN HISTORICAL PERSPECTIVE

In this section, Shiller puts the stock market in perspective, beginning with how it was in the year 2000. He asserts that while Dow Jones has actually tripled ever since 1994, the GDP, along with personal income, has only grown by about 30%. Additionally, profits shown by corporates were lesser than 60% during the same time.

With informative charts, Shiller explains more about two variables, namely the market earnings and the market level. As the earnings continued steadily, one can see through the charts that the market level took off with a huge spike. Shiller declares that the ratio between the stock prices and the earnings is ridiculous. He then questions if there’s any sort of relevance when it comes to the market’s P/E and goes ahead to plot the PE since 1980 against the subsequent returns. The graph quickly reveals that the relationship between the P/E and the returns are negative (shows ten years). Based on that very graph, it is determined that the returns since 2000 over the next ten years would be negative and in reality, it is actually negative.

CHAPTER 2: PRECIPITATING FACTORS: THE INTERNET, THE BABY BOOM, AND OTHER EVENTS

In this section, Shiller explores a few factors that could play an important role in the growth of the market. As the economy growth and earnings weren’t responsible for the incredible growth of the stock market back in the 90s, Shiller takes a look at the other factors. According to him, a single factor can’t be completely responsible, but a combination of numerous factors tempts investors to bid high prices, thereby resulting in ratios that were completely unheard of.

The factors are:

The internet – Corporates in the US witnessed about 36% growth in 1994 while there was an increase of about 8% in 1995 and 10% during 1996. This growth coincided with the emergence of the internet and although the growth had nothing to do with the internet in reality, Shiller says that the public impressions played an important role in it.

Economic rival decline – The US has a competitive relationship with its several economic rivals and as these rivals decline in their growth, it’s often viewed as good news for the stock market in the US.

Cultural changes contributing to the success in business – The bull market is usually accompanied by a spike in materialistic values. For instance, firms give bonuses to employees who participate in the operation of the company by buying shares.

Tax cuts and republican Congress – During 1994 to 97, the investors held on to their capital gains until they had the tax cut. Naturally, this makes the stock prices go higher.

The baby boom that marked incredibly high birth rates during 1964 to 1966 was also responsible for the stock market surge although it was a perceived effect.

CHAPTER 3: AMPLIFICATION MECHANISMS: NATURALLY OCCURRING PONZI PROCESSES

In this section, the amplification mechanisms that involve the investor expectations and confidence are discussed in detail. According to Shiller, these mechanisms operate in a manner where the positive feedback encourages others to a point where there’s a collapse of the market. Interestingly, the confidence of the investors has increased dramatically in the late 90s and this could have happened because of the expectations of higher returns. Shiller asserts that several factors, including regret could have caused that to occur and also compares the process to a Ponzi scheme where investors are convinced to start with small investments in the hopes that they invest more as the returns increase.

CHAPTER 4: THE NEWS MEDIA

In this chapter, the role of the media during the stock bubble in 2000 is discussed in detail. According to Shiller, newspapers are responsible for speculative bubbles and play very important roles in the process. When several people in a large group tend to think almost alike, there are a lot of chances for a bubble to occur. Additionally, this can also make the market fall or rise by huge amounts because of the people.

Shiller states that he is disappointed with the explanations presented by the media for the occurrences in the market. For instance, the media is rife with stories about the rise or fall of the stock market on any given day; however, Shiller points out that these facts are fallacious and don’t really help the public. He further displays news item stories that go way back to 1929 and argues that the media didn’t report anything that was unexpected.

CHAPTER 5: NEW ERA ECONOMIC THINKING

In this section of the book, Shiller talks about how optimism can change the course of the stock market. Back in 1901, everybody was very optimistic about technology changing their lives. The future seemed fantastic and by the 1920s, another fresh wave of optimism surged among people, thereby leading to an increase in the production of automobiles. As the homes in the US embraced electricity, the prices of light bulbs, washing machines and vacuum cleaners soared up too. Shiller calls this the “New Era” where new concepts were introduced at a dizzying pace.

During the 50s and the 60s, there was an enormous growth in the usage of devices like televisions. People believed that the stocks were held in safe and strong hands and assumed that crashes were never going to happen. It is important to note that every “New Era” filled with optimism was followed by extreme pessimism.

CHAPTER 6: NEW ERAS AND BUBBLES AROUND THE WORLD

Here, Shiller discusses some of the largest moves by the stock index all over the globe. After examining the moves that span for different time intervals, Shiller tracks the returns that followed these time periods. By closely analyzing one-year returns and five-year returns, Shiller states that the one-year returns are seen all over the place, but the enormous strength seen is because of changes in regime where a dictator has been ousted and the control is taken over by the government. However, when the one-year intervals following the declines are checked, it’s determined that the stock returns all over the globe are positive, with about 6 instances out of 25 showing negative returns.

Further, when the results of the five-year periods following extreme price changes are analyzed, it’s clear that there is a bubble effect. Shiller also gives an example to explain this by talking about the 1253% growth in Philippines that occurred due to a change in regime. Basically, this proves that something that went up came back down and vice versa. Due to this, Shiller states that the likelihood of a major bubble in the US (as on year 2000) can’t simply be ignored.

CHAPTER 7: PSYCHOLOGICAL ANCHORS FOR THE MARKET

Here, Shiller talks about the psychological anchors that can influence the people who invest in the stock market. He asks the question as to why the market is at such a level. Realistically, this is a very interesting question since the market level can’t be determined with solid accuracy. First off, Shiller starts with concepts that are popular in investing when it comes to the matter of psychology. Usually, one would have to believe that the investors are ecstatic during a boom in the market and stricken with panic when it crashes. However, Shiller disagrees and argues that it’s a wrong perception because investors generally try to be sensible and display certain behavior that helps them determine their actions during uncertain times.

Shiller further discusses moral anchors and quantitative anchors that play a major role when it comes to investing. While quantitative anchors lead the investors into believing that a particular asset’s price should be priced at a certain number, moral anchors determines the strong reasons that often compels people to invest in stocks.

CHAPTER 8: HERD BEHAVIOR AND EPIDEMICS

In this chapter, Shiller discusses about epidemics and herd behavior. He says that as humans, we rarely think independently and tend to do things simply because somebody else has done it. This is known as the herd behavior and investors also fall prey to it. People are so influenced by others that they override their opinions when they hear that a majority of people have different opinions. Shiller talks about the experiments conducted by Gerard and Deutsch that prove that even rational humans believe that the majority is always accurate when compared to their own individual opinions.

For instance, if a man is asked to choose one restaurant between two restaurants with absolutely no information about them, he will simply choose one of them randomly. However, if another person is asked to do the same and he sees the first person entering one restaurant, he is more likely to enter the same restaurant just because he saw another person doing so. Shiller concludes that most people use only about 10% of their brain and that applies even when they are investing.

CHAPTER 9: EFFICIENT MARKETS, RANDOM WALKS, AND BUBBLES

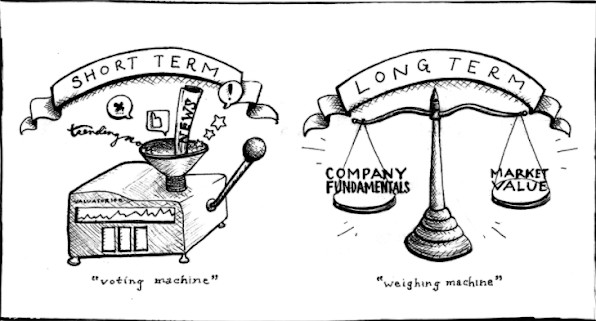

In this section, Shiller talks about the EMH or Efficient Market Hypotheses that asserts that the financial prices are reflected accurately at all times. Basically, this theory supports the idea that smart people will always exploit good opportunities in the market, thereby increasing their wealth by bidding low on high prices and vice versa. However, Shiller disagrees and says that this theory hasn’t taken the mispricing into account and mispricing can usually take a long time to correct and can even go on up to decades. In such scenarios, smart people can’t make money quickly and this doesn’t necessarily make amazing opportunities to suddenly vanish.

To explain his theory, Shiller cites a few companies and their prices. For instance, eToys, in 1999, was traded for a whopping $8 billion even when their sales were around $30 million with negative profits. He also talks about other instances including Holland’s Tulip Mania to make the reader understand the theory in a better manner. He further declares that the EMH has several systemic problems and cites his own extensive research.

CHAPTER 10: INVESTOR LEARNING – AND UNLEARNING

In this chapter, Shiller has explored another theory that’s used while justifying stock prices that are ridiculously high. This theory simply states that the very reason for the exuberance in the stock market is because the people have realized the advantages of putting money in the stock market. Thanks to extensive research and data that displays statistics collected over several decades, people may have understood the long-term advantages of the stock market.

According to Shiller, this particular “learning” that took place late in the 90s has also shown up at different points in history. Armed with publications, Shiller shows that these particular arguments have also taken place during previous bubbles that have occurred decades ago. However, he says that although the public have learned about the advantages, they have also thought otherwise during periods of stock market crashes.

CHAPTER 11: SPECULATIVE VOLATILITY IN A FREE SOCIETY

In this final section, Shiller talks about the risks and dangers involved in ignoring market levels when they are highly priced. To an onlooker, it might seem like the stock market will simply get back to where it was prior to the crash, but that’s not true. Although it looks harmless because there’s no physical destruction, the problem is that the loss can be very harsh for certain people. A crash could make someone unbelievably rich and someone else can suddenly become equally poor.

Additionally, Shiller says that other new factors can crop up to influence the rise or fall of the stock market. While some of these factors may be supportive, some may be equally destructive, but the problem lies in the fact that it’s not possible to anticipate when that might occur. Therefore, Shiller warns investors to take decisions based on their circumstances and reduce their holdings in the US stocks (as on year 2000). He also states that an investor shouldn’t be completely dependent on one single investment and should diversity his assets thoroughly.

AUTHOR

ANKIT VERMA

ASSISTANT PROFESSOR

Comments

Post a Comment