Too Big to Fail By Andrew Ross Sorkin

Take-Aways

In 2008, Lehman Brothers were on the verge of collapse.

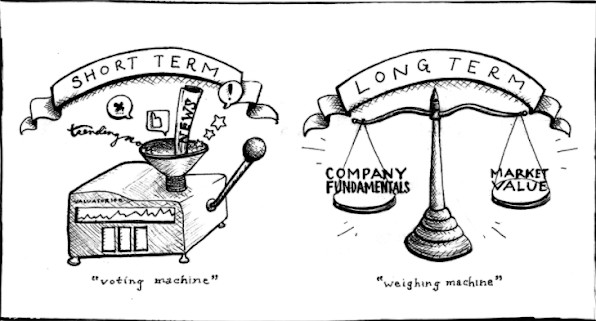

Its CEO Richard S. Fuld Jr. blamed the declining share price on short-sellers.

Fuld refused to recognize his bank’s weaknesses. Instead, he sought cash fill from Warren Buffett. He even pursued mergers with Bank of America (BOA) and Barclays.

Treasury Secretary Henry Hank Paulson rejected the use of public money to save Lehman.

Hence, in September 2008, Lehman filed for bankruptcy.

Paulson opened about AIG’s $85bn bailout the next day.

Investors got confused by this message. That is, Lehman could fall, but AIG didn’t.

To cool down the uproar, Paulson pushed a plan. This plan would give the US government $500bn to purchase toxic assets.

But, Congress hesitated. So, Paulson redrafted the plan. It was now to assume direct ownership of stocks in banks. He managed to get the leading bankers to agree.

The Troubled Asset Relief Program normalized banks and increased investor confidence. This plan put the market back on the path to recovery.

Lehman Teeters and Puts All of Wall Street on the Brink

It was September 2008. American economy and Wall Street faced a tragic collapse. It was just a year before that markets were celebrating big profits. These gains were a result of mortgage innovations. People from finance sector rewarded themselves highly. They collected $53bn in compensation that year. Lloyd C. Blankfein, Goldman Sachs CEO made $68mn. Then this real estate bubble burst. Hence, Wall Street started falling apart. Its debt-to-equity ratio was 32:1. Such high-risk level ensured gains during the boom. But, proved disastrous in a lousy market.

Fuld’s Risky Approach

JPMorgan Chase said on March 17, 2008, that it would save Bear Stearns. Meanwhile, Lehman Brothers were also on the verge of collapse. Its trading partners were uneasy, and investors were doubtful. This sent its once-strong share fluctuating wildly. So-much-so that stocks fell 48% in just an hour of trading. Richard Fuld, Lehman’s CEO was responsible for the bank’s risky ways. But, in some ways, this didn’t match his typical style. Though he increased risk, Fuld did remind his people that his method had flaws. Then, taxing times came quicker and harder than he expected. Fuld was called “The Gorilla” for his aggressive style. The success of Goldman Sachs encouraged Fuld to push Lehman’s leverage above traditional roots.

This strategy was useful during the real-estate bubble. That time, Fuld’s shares in Lehman increased his net worth to $1bn. But, Bear’s panic sale was the breaking point. The new victim was Lehman. Many people saw the bank’s likely failure as only an example of capitalism. But, even they knew that it could spell disaster for the financial sector. The financial market had savings of so many people and paid millions of workers.

“THE SHAPE OF WALL STREET AND THE GLOBAL FINANCIAL SYSTEM CHANGED ALMOST BEYOND RECOGNITION.”

Task Force to Revive the Economy

If Lehman fell, Merrill Lynch, Citigroup, and others would be in danger. A task-force was created to save the financial markets from falling. This force included Henry Hank Paulson, US Treasury secretary. Paulson was earlier a Goldman Sachs exec. Timothy Geithner, who headed NY Federal Reserve was also in the group. Next was Jamie Dimon, JPMorgan Chase exec. And finally, Ben Bernanke, the Federal Reserve chair. Dimon and Paulson worked on saving Bear. That time, Paulson advised Dimon to pit $2/share. But, Dimon went with $10, so stockholders won’t reject it. As per Paulson, this was higher than what Bear deserved.

Short-Sellers

As Lehman’s liquidity and share fell, Fuld asked Warren Buffett for cash-fill. But, Buffett refused. He thought it to be too risky. Fuld had increased its debt-to-equity ratio to 30.7:1. He was obsessed with his belief that short-sellers led to the fall in price. So, he always complained that “shorts” were spreading wrong rumors. He approached Jim Cramer, CNBC host to tell the audience that Lehman was fine. But Cramer told Fuld that the bank needed cash. David Einhorn, a short-seller had foreseen huge issues at Lehman. He especially found the way it valued non-liquid assets like mortgages, troublesome. On May 21, 2008, Einhorn advised investors to sell Lehman shares short. Because the bank was slow in marking its non-liquid assets down to real value.

Joseph Gregory

Many insiders pointed fingers at Fuld’s right-hand Joseph Gregory for Lehman’s woes. Gregory dealt with unpleasant personal tasks like firing. His spending practices represented him as a Wall Street fat cat. He traveled from his mansion to Lehman’s office by helicopter. When these two men were running Lehman, Wall-Street’s business radically changed. Banks were no longer making or holding loans. Instead, they were focusing on producing loans which changed hands many times. All this, while their assets were wrapped into derivatives. The final product had little similarity to the original loan. Lehman traders were laughing at Gregory’s lack of market knowledge. But, they feared speaking up against Lehman’s growing risky approach. Gregory wanted more risky transactions and didn’t want to hear disagreements.

Bankruptcies and Bailouts

As Lehman was falling apart, AIG was also nearing the edge. AIG’s officials were sure that things were fine. Why? Because it had $1 trillion in assets and $40bn in cash. Plus, it had an attractive business supporting insurance on collateral debts. It was just too huge to fail. But, the mortgage market was also falling. And this didn’t mean well for the AIG. The giant insurer had over $500bn in subprime mortgages, mainly for European lenders. Its managers were revaluing credit default swaps. They found that its losses in November and December reached $5bn. This was way over the $1bn earlier projected. By May, it suffered a 1st quarter loss of $7.8bn. This was AIG’s most significant loss ever. Standard & Poor’s gave AIG a rating of AA minus.

Paulson was aware that a bailout was unavoidable. He had declared State takeovers of mortgage firms like Freddie Mac and Fannie Mae. But, critics called him “Mr. Bailout” and a “socialist.” Such charges shocked Paulson, who had made a fortune as head of Goldman Sachs. Also, he was a loyal supporter of the conservative Bush. Such taunts affected his methods in the following months. For example, when Barclays sought State help to buy Lehman, Paulson refused. Lehman’s fall was clear when Chase asked it to repay $5bn in collateral. Lehman sought Geithner’s help. But, Geithner said he couldn’t tell any bank not to save itself.

The Confusing Behavior of Execs

When Barclays was negotiating for a buy-out, Fuld’s behavior was baffling. In fact, in one meeting he even dared Barclay’s President Bob Diamond. He told Bob to look into the white of his eyes. Plus, he proposed to step aside once the merger was done. All this confused Bob, who had been assuming that Fuld wouldn’t stay. But, Fuld had his reasons to be in a rage. Like many Lehman execs, he had much of his net worth in the company. In just a few months he lost $649mn as the price of his 10.9mn shares fell.

Efforts for Lehman’s Bailout

Paulson and Geithner called a meeting of Wall Street execs. This was to talk about a private bailout of Lehman. Because the government won’t be bailing it out. But, Lehman’s competitors didn’t respond positively. Saving a rival would hurt them. Paulson didn’t call Fuld to the meeting. He believed Fuld was in denial.

Ken Lewis, CEO of Bank of America agreed to think about buying Lehman. But, he started avoiding Fuld, after doing his research. Tired of being prevented, Fuld called Lewis at his home. But, Lewis’ wife asked him to stop calling. Geithner and Paulson tried keeping Lewis engaged. It was because Barclays was still interested in Lehman. Plus, the government would prefer bids by two parties.

“FIXED-INCOME TRADING WAS NOTHING LIKE FULD AND GREGORY KNEW IN THEIR DAY: BANKS WERE CREATING INCREASINGLY COMPLEX PRODUCTS MANY LEVELS REMOVED FROM THE UNDERLYING ASSET.”

Lehman’s Bankruptcy

What Lehman’s assets were worth was a huge question. The company valued its investments and loans at $42bn. But, many guessed the real sum to be less than half that figure. Barclays was still interested. But, when they were about the close the deal, British regulators didn’t approve. As per them, Lehman was a “cancer” which would affect UK’s financial sector. Now there were no buyers for the firm. So, Geithner and Paulson decided bankruptcy was the final option. And, when that happened, the stockholders suffered significant losses. Fuld’s stocks worth millions of dollars now valued only $65,486.72.

Efforts to Bailout AIG

AIG’s CEO Robert Willumstad also went to Warren Buffett for a bailout. He proposed selling AIG’s casualty wing and property to Buffett for $20-$25bn. Willumstad said he’d mail the data to Buffett. But, Buffett said he doesn’t use e-mail. So, Willumstad faxed all of it. But, Buffett only needed an hour to decline the offer.

The markets were highly unstable. So, Dimon asked his JPMorgan team to expect many failures besides AIG and Lehman. These included the fall of Goldman Sachs, Morgan Stanley, and Merrill. Merrill was already on the verge of fall. A year before, Stanley O’Neal, its then CEO discussed a deal with BOA. But, O’Neal wanted a higher premium than what BOA would pay. Paulson asked John Thain, Merrill’s new CEO, to strike a deal with BOA. Merrill had to sell fast. Because Paulson warned Thain that only God could help the firm otherwise. So, BOA agreed to pay $29/share for Merrill. This was the highest premium ever in the history of bank mergers.

An $85 Billion Bailout for AIG

When JPMorgan’s team dug into AIG’s books, horrible surprises came up. Willumstad didn’t know the amount its securities lending unit was losing. AIG’s estimates for its losses was $40bn. But, JPMorgan estimated it to be $60bn. AIG was doing risky lending. But, it also sold bonds, annuities and life insurance efficiently. Paulson and Bernanke didn’t want AIG’s vast empire to hurt middle-class families. So, they planned a bailout of $85bn.

The TARP

The infusion of $85bn into AIG couldn’t calm the markets. Its save came just a day after Lehman’s fall. So, the government’s approach confused the markets. Everyone was asking what the rules were. How can the State save one firm and let others fail? These questions left Geithner and Paulson with little choice. They had to stage another dramatic bailout. Paulson proposed the Congress a $500bn plan to buy toxic assets. Hence, he declared the Troubled Asset Relief Program (TARP) on Sept. 19, 2008. Paulson’s advisors did warn him the price tag may reach $1 trillion. But, he knew that declaring such a figure was political suicide. Paulson had now become a key player in Washington. Newsweek magazine’s cover called him “King Henry.”

Not Many Takers for TARP

Goldman Sachs did way better than AIG or Lehman. It offered Buffett many favorable terms to buy a $5bn ownership in the firm. Buffett’s acceptance led other investors to purchase an extra $5bn in its shares. But, while Goldman was fine, Paulson’s TARP wasn’t. Congress pulled its hands back from it. The Republicans feared that it stood for sneaking socialism. And, the Democrats worried that Paulson was bailing his Wall-Street friends out.

Paulson was now getting stressed. Investors were also not feeling any better. The day Congress voted against TARP, Dow Jones fell 777.68 points. Paulson thought about his offer again. He followed the advice of Neel Kashkari, Asst. Treasury Secretary. Now, rather than purchasing toxic assets, the State must buy bank ownership. Sheila C. Bair was heading the Federal Deposit Insurance Corp. She agreed to increase the bank’s coverage limit. The feds didn’t want to buy ownership in the banks.

The Secret Meeting

Paulson called the execs of Chase, Wells-Fargo, Goldman and six other big banks. It was a clandestine meeting with regulators. He didn’t even tell the execs why he was meeting them. His message was plain and simple. The government will use TARP to shore up banks. It will use TARP to purchase $250mn in preferred shares in leading banks. If the execs didn’t accept the fed money, they’d face legal scrutiny. To inform the seriousness of the plan, Paulson brought Bernanke and Geithner along. He also had other bank regulators like Bair on hand. The nine bankers realized the importance of the situation. They were too intimidated by Paulson’s approach. And so, they agreed with the plan.

“‘WE HAVE TO PREPARE FOR THE ABSOLUTELY WORST CASE,’ DIMON TOLD HIS [JPMORGAN CHASE] STAFF…‘THIS IS ABOUT OUR SURVIVAL’.”

All’s Well that Ends Well

But again, there were questions. Wells Fargo exec Richard Kovacevich was a hard sell. He questioned why the government would punish his bank for the risky approach of others. But, Paulson gave him a right answer. He said that if Richard didn’t agree, his bank would be labeled undercapitalized. And so, Wells Fargo will have to raise money privately. Merrill’s Thain needed assurance that his compensation won’t be affected. Paulson told the execs to call their board members and discuss the proposal. Dimon told his board that the plan was terrible for Chase. After all, his bank was stable and healthy. Plus, the plan will save many of its competitors. But, he also told the board that taking the money will improve the financial system. In the end, all nine execs signed the plan. And, this is how Wall Street bounced back.

Too Big to Fail Review

Too big to fail is the book written by the famous writer Andrew Ross Sorkin. Article summary provides the complete picture of the book efficiently. The main idea is about the tragic collapse of the American economy in 2008. During the collapse, many people turned their fortune as finance sectors rewarded highly when the other areas were facing issues and sustainability problems. It was expected that financial markets would fall therefore forces were developed to protect the financial institutes from the dramatic collapse or falling. In the whole summary main character is Lehman around him the entire book story revolves. Lehman was on the verge of collapse. He put all on the brink. His shares and liquidity were fell, and he was filed for bankruptcy. The whole summary provides information to the people about the reasons for the big failure for the Lehman. It projects that how the wrong strategies adopted at the wrong times destroyed the financial career of the Lehman.

While the fortune of the Lehman was falling, the AIG was assuming that everything for them would be fine. AIG was in strong financial condition as fixes assets, insurance and market equity of the AIG were strong factors for the organization to be sustained even after the collapse. But fall in the mortgage market was not a good sign for the AIG and as a result of the wrong decision they faced a loss in the market. Andrew Ross Sorkin wrote that it was the most significant loss in the history of AIG. The whole book is about the financial decision of the various prominent institutes and organizations in the financial collapse of 2008. Book presents the importance of complete market analysis while taking decisions. Failure and bankruptcy of the Lehman also affected its stockholders.

Too Big to Fail Quotes

“In a period of less than 18 months, Wall Street had gone from celebrating its most profitable age to finding itself on the brink of an epochal devastation.”

“The shape of Wall Street and the global financial system changed almost beyond recognition.”

“Fixed-income trading was nothing like Fuld and Gregory knew in their day: Banks were creating increasingly complex products many levels removed from the underlying asset.”

“‘We have to prepare for the absolutely worst case,’ Dimon told his [JPMorgan Chase] staff…‘This is about our survival’.”

“Cassandras in both business and academia… warned that all this financial engineering would end badly.”

“Hank Paulson believed he was fighting the good fight… to save the economic system, but for his efforts he was being branded as little less than an enemy… to the American way of life.”

“Buoyed by their earnings, AIG executives stubbornly clung to the belief that their firm was invulnerable.”

“AIG was such a sprawling mess, and its computer systems so bizarrely antiquated, that no one had until that moment discovered that its securities lending business had been losing money at a rapid clip for the past two weeks.”

“Eighty-five billion dollars was more than the annual budget of Singapore and Taiwan combined; who could… understand a figure of that size.”

“For better or worse, Goldman, like so many of the nation’s largest financial institutions, remains too big to fail.”

“They got to the question Geithner and Paulson had been debating all day: How forceful could they be?”

“It was the first time – perhaps the only time – that the nine most powerful CEOs in American finance and their regulators would be in the same room at the same time.” “The bankers sat stunned. If Paulson’s aim had been to shock and awe them, the tactic had worked spectacularly well.”

AUTHOR

ANKIT VERMA

ASSISTANT PROFESSOR

Comments

Post a Comment