One Up on Wall Street By Peter Lynch summary

Investment Vehicles

Consider this: rather than purchasing a Subaru in 1977; you bought the company’s stock for the same price. At that time the stock price was $2. Then if you had sold the same in 1986, your earning would have amounted to $1 million.

Great values wait for you in the stock market. The ideal way to get a great stock is through personal experience. Apple Computers, Taco Bell, Volvo, Pier 1 Imports and Dunkin Donuts are only some of the winning stocks.

As a person, you have many benefits over professional investors. But, you need to make your way through bureaucracies to get ahead. It is easier for you to find new firms and products before the professionals. All this only with your daily experience. But, always ask the following to yourself before investing:

· What do you hope to receive when you invest?

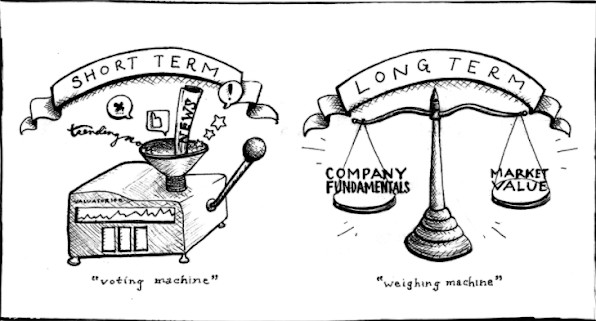

· Is your investment for short-term or long-term? Consider long-term always.

· How will you respond if the prices fall unexpectedly? Ignore near-term swings.

· Do you have a home? Buy a house before investing in stocks.

Research is the best road to investment success. Gain as much knowledge as possible. Do not invest in stocks; instead, seek successful firms to invest in the stock market. Find a firm you think will put up a superior performance irrespective of the swings. You do not want to depend on macroeconomic factors to save you. If your focus is on successful firms, the stock market will not bother you anymore. Warren Buffett says that for him the stock market is non-existent. For him, it exists only as a reference to check if anyone is doing something stupid.

Finding a “Tenbagger”

A “tenbagger” is a stock which earns ten times return on investment. You will find a tenbagger when you go shopping. The first sign that a stock will rise quickly is a warm reaction from customers. You have an edge in being a consumer. Likewise, working in business also offers an edge, as you get exposure to successful firms. This offers a benefit in identifying a likely tenbagger. The first step of doing your research is to find the story of the company. This will not take more than a couple of hours. Plus, if you base your decision on a specific product the firm sells, identify the impact of the product on the firm. Understand the company’s size as smaller companies are likely to have huge value swings. Also, find out the company’s type. There are six classes:

1. “Slow growers” – These are big, established firms. They are at a stage where they will rise only slightly quicker than the overall economy.

2. “Stalwarts” – Such established firms are relatively dynamic. But they are not very agile. Examples include Procter & Gamble, Coca-Cola, and Bristol-Myers.

3. “Fast growers” – These small firms are rising aggressively. In fact, even at a rate of 25% per year. A few of them can make your portfolio stronger.

4. “Cyclicals” – Such companies have a natural swing in their stock performance. Airlines, automobile manufacturers, defense, tire, and steel are all cyclical.

5. “Asset plays” – These firms have valuable assets. You think you know something about them which the Wall Street has overlooked. Wall Street ignores things many times.

6. “Turnarounds” – Such companies can provide great opportunities. When big firms like Ford and Chrysler face issues, they have the ability to turnaround things fast.

Firms change categories over time. So, check your investments to ensure you’re holding what you initially bought.

Getting the Story

The story of a company is an explanation of its unique positioning to succeed. It helps to have some knowledge about the business of the firm. Once you’re familiar with a firm, you can understand that a person with even a little brain can run it. Maybe because of its edge in the marketplace or its easy production process. These features are appealing as they take you away from the whims of management. Look for the below mentioned 13 extra features to ensure a firm is an appealing investment:

1. “It seems dull or ridiculous.”

2. “It’s doing something boring.”

3. “It’s doing something unpleasant.”

4. “It’s a by-product”.

5. “The institutions don’t control it. The market analysts don’t chase it.”

6. “There’s something not good about it.”

7. “The rumors are many. For example. it’s involved with Mafia or toxic waste.”

8. “It’s from a no-growth sector.”

9. “It has a niche.”

10. “People need to continue purchasing it.”

11. “It uses technology”.

12. “The buyers are insiders.”

13. “The firm is doing share buy-backs.”

Some hints also suggest which stocks to ignore. Stay away from the trending stock in the hottest sector. It’s possibly not worth it. Also stay away from:

· “The next big thing” – If you hear a firm is “the next Microsoft” or anything bright, avoid. Such sought-after stocks rarely hold up.

· “Diworsefications” – When a firm buys another firm claiming it as diversification, it makes things worse. Merged firms typically do not have the alleged synergies. You may end up paying for stupid deals.

· “The whisper stock” – If anyone lowers his voice to tell you about a stock, hide. It’s very likely that they represent long shots. Avoid claims which say that they’ll solve a significant issue.

· “The middleman” – A firm which acts as a middleman and mainly sells to one/two consumers is vulnerable. It can never afford to lose even one consumer.

· “The stock has an interesting name” – Pick prominent firms with boring names which shun investors. This way there’ll be no one to drive up the prices artificially.

Owning a share of the stock means part ownership of a company. The earnings and assets of that company are very crucial to its success. When you try finding out if a stock will grow, you want to know can the company succeed. A stock is an actual investment in a real firm which has actual earnings. It is not a child’s play. Before buying a stock, you must know why it excites you. You can give this explanation to yourself or someone else. But, you must be capable of explaining why you want to do it. This way you’ll be sure you know the firm’s values.

The Straight Story

Investors who use brokerage services usually don’t insist on getting full-research – like P/E ratios etc. – to support their claims. Even if you’re not working with a broker, the details you need are easily obtainable. Of course, rumors are very fascinating. Hence, overhearing a gossip in an elevator draws more attention. Even a firm’s quarterly reports can’t bring this much attention.

Another way to obtain details is to call up the firm. Inquire their investor relations person about your doubts. Don’t ask dubious questions like when will the stock prices fall. Nobody knows for sure, and only a newbie will ask such questions. Plus, you know it’s bad manners to ask someone you barely know about their salary, right? Same way, it’s bad manners to ask the investor relations, “how much will the firm earn this quarter?” If you do want to inquire about the earnings, ask “how much does the Wall Street predict your earnings for the next year?”

Another way to receive data is by studying the annual report. Seek three things. Firstly, find the firm’s net cash position by deducting long-term debt form current assets. The higher the surplus, the better. Divide this by some outstanding shares. You will get the net cash value/share. This is the floor of that stock. It will never go that point below.

Secondly, compare the assets with the debt in the firm’s balance sheet. If the shareholder equity is said $20bn, and long-run debt is $2bn, this means debt is 10% of equity. A typical balance sheet has around 25% debt. Check if the number of outstanding shares is rising or falling in the past few years. This will tell you if the firm is buying back its stock, which is a great sign. When studying your potential investment firm consider: pension plans, cash flow, growth rate, and inventories. Also, see if insiders are buying many shares and the proportion owned by institutions (the lesser, the better). Once you invest, follow the firm’s story every 2-3 months. The firm may enter a new stage in its lifecycle. Or the trends of the market might change.

“BY THE WAY, THE ODDS AGAINST MAKING A LIVING IN THE DAY-TRADING BUSINESS ARE ABOUT THE SAME AS THE ODDS AGAINST MAKING A LIVING AT RACETRACKS, BLACKJACK TABLES OR VIDEO POKER. IN FACT, I THINK OF DAY TRADING AS AT-HOME CASINO CARE.”

The 12 Silliest Things

The 12 main misconceptions people have about stocks include:

1. “It is already so down; it won’t go any lower”. You can never know the lowest point of stock like you can never know its pinnacle. People who think they can are foolish.

2. “You can tell when a share hits rock-bottom”. Only because a stock has fallen to enormous levels, doesn’t imply it will not drop any further. It may always be.

3. “If the stock is this high, then it won’t go any higher”. No artificial limit decides how high a stock may go.

4. “It is just $3 per share; how much can I lose?”. The clear answer is $3 per share. Such a mindset is not right. A loss, regardless of its size, is a loss. Prevent them. You do not want to invest in losers.

5. “They will come back ultimately”. Some firms never return.

6. “The time before the dawn is always the darkest”. You require more solid grounds because things can get even darker.

7. “When it gets back to $10, I’ll sell”. You should try to sell immediately. By setting artificial targets like this, the stock is unable ever to achieve it. You may end up with under-performers for a long time.

8. “I don’t worry. Conservative stocks do not swing much”. It is possible for anything to swing these days. There are no guarantees. Don’t be content about your portfolio.

9. “It’s been so long, but nothing has happened”. Be patient. The day after you are fed up with waiting and sell is going to be the day the prices soar.

10. “Look how much I’ve lost: I should have bought it earlier!”. You’ll not lose money if you postpone buying. If you think like this, you’re likely to turn desperate and err.

11. “I should not have missed it. I’ll try to get the next one.” If you miss it, let it go.

12. “The stock’s high, so my predictions are right.” Don’t ever decide on swings. Only because a stock changes, doesn’t imply your predictions were right or wrong. Only time can tell this.

One Up On Wall Street Review

One Up On Wall Street is a beneficial book for every individual who wants to earn the knowledge about the behavior of stocks in the financial market and what is the best way to select the securities’ best portfolio. The writer of the book has shared his real-life experiences in the book and told the audience that how he dealt with and how he felt about the success and losses when investing in the stock market. We like the book, and seemingly the author has made such difficult concepts and terms so much easier. Initially, We picked the book after reading so much about the investing style of Warren Buffett as We wanted to explore the investing style of some other as well. Although the book was a good read, it was specific to the style of one single personality where the author explained how he developed his success strategies.

While the book is perfect to read, it is specific to the personal investing style of the author. The experiences of the author are dated enough that makes it inapplicable entirely and anymore as the financial markets are emerging day by day. Hence, it is better to classify the book as the history or biography of the investing style of the author. There is the forward written in the book in which the one update has provided by the author to his material, but, We think, there should have been more such updates so that the book could be entirely classified as the guide on making the personal investing decisions. The good thing about the book is that it is easily understandable for non-financial people because everything is described easily.

One Up On Wall Street Quotes

“This book One Up On Wall Street was written to offer encouragement and basic information to the individual investor.”

“By the way, the odds against making a living in the day-trading business are about the same as the odds against making a living at racetracks, blackjack tables or video poker. In fact, I think of day trading as at-home casino care.”

“The basic story remains simple and never-ending. Stocks aren’t lottery tickets. There’s a company attached to every share.”

“It’s impossible to distinguish cod from shrimp when your mutual fund has lost the equivalent of the GNP of a small, seagoing nation.”

“But rule number one, in my book, is: Stop listening to professionals.”

“Things inside humans make them terrible stock market timers.”

“Never invest in any company before you’ve done the homework on the company’s earnings prospects, financial condition, competitive position, plans for expansion, and so forth.”

“When E.F. Hutton talks, everybody is supposed to be listening, but that’s just the problem. Everybody ought to be trying to fall asleep.”

“Nothing has occurred to shake my conviction that the typical amateur has advantages over the typical professional fund jockey.”

“Whether it’s a 508-point day or a 108-point day, in the end, superior companies will succeed, and mediocre companies will fail, and investors in each will be rewarded accordingly.” ”To the list of famous oxymorons – military intelligence, learned professor, deafening silence, and jumbo shrimp – I’d add professional investing.”

“Success is one thing, but it’s more important not to look bad if you fail. There’s an unwritten rule on Wall Street: ’You’ll never lose your job losing your client’s money on IBM.’”

AUTHOR

ANKIT VERMA

ASSISTANT PROFESSOR

Comments

Post a Comment