Reminiscences of a Stock Operator By Edwin Lefèvre

When people sell a share short, they intend to repurchase it for less. This is how they expect to earn a profit.

The market falls when there’re many sellers. Or when selling stops.

“Larry Livingston” (fictional name for Jesse Livermore) was excellent at mental math.

When Livingston was 15, he started day-trading for a living.

Livingston earned $1,000, the equal of one year’s income, at just 15.

He had a unique “ticker sense.” Livingston could remember stock trades two decades later.

While Livingston was building a stock position, he ordered buy and sell commands. This was to test the market’s strength.

Naïve investors lose money in share market because of many reasons. It could be poor judgment, evil temper, bad timing or lack of knowledge.

To be successful, be patient, confident, and trust your judgment. Also, invest in trends and keep a formal sell and buy discipline.

If you’re buying shares, every new purchase must be higher than the old one.

Great Operators: The Voice of 1922

Any fall in the share market takes down many people. It turns their profits into losses. Broad market fall often begins with the most popular stocks. Then, it moves to lesser known ones. When strong shares decline, weak shares suffer quick fall. Hence, many small investors are left shocked. They fruitlessly hope for their stocks to bounce back.

When investors ask brokers why these breaks happen, they don’t have an answer. Or they may blame it on a “bear raid.” That is, the issue could be with the investors who sell short. For this to occur, short-sellers expect their share prices to fall. This may discourage other speculators. Especially the ones who bought shares on margin and earn only when price increases. Commissioned brokers earn either way. Hence, they don’t have any obligation to the public.

There’s an even worse situation. When brokers tell their clients that a bull market is over, the client doesn’t listen. This only increases the chances against share speculators. The investors of 1923 may seem a bit different than investors from 15-20 years ago. But, their purpose is the same. Most speculators learn that a harsh lesson is the best teacher.

What if a great speculator came? One who has the power of moving investment markets. An operator is so big he could perform a bear-raid. Or even take markets up. In the old days, such men were pool operators or ran share syndicates. Now, they’re hard to find. But, this is the reason you must meet Lawrence Livingston.

Old Masters

Livingston lived in a mansion. He had many butlers and esteemed pieces of art. Rumour was that he underwent many big fortunes. But, this mansion was a proof of huge current net worth. Livingston himself was healthy looking and tall. He never showed any hint of nervousness. Instead, he seemed to be a man who made decisions with a fresh mind. When we first met, he wasn’t very warm. Nor was there any sign of the great mind he used to build his fortune.

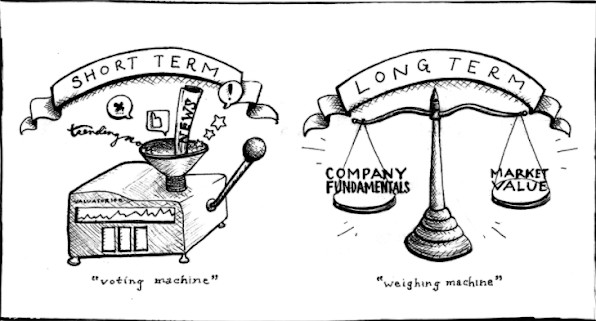

Livingston told me that the market raids itself very often. When there’s mass selling out by investors, they blame the big speculators. But, this is wrong. Markets fall when too many sellers exist. When selling stops, the market sets itself for recovery. Livingston liked being a buyer.

Greed of Speculators

All investors like bullish market. When the market falls, everyone blames Wall Street. But, often professional investors are not to be blamed. Instead, blame the businessmen, merchants, and speculators. These people wish to make quick money with less effort. They fool themselves into believing that they’re allowed to profit more in the market. So, when they lose, it’s not the market’s fault, it’s theirs.

Speaking about protective laws is of no use. Laws can’t save anyone from their ignorance and greed. It’s always the same story. Speculators come to the market full of greed, laziness, and vanity. They depend on brokers or tipsters. Rather than using their brains, they use margins. When the market rises, speculators wish it’ll rise more. Hence, they don’t take their profits. And, when the market drops, they’re unable to act.

“A PICTURESQUE FIGURE, THIS BREEZY BUCCANEER OF BOODLE, FLAMBOYANTLY THEATRICAL, INCREDIBLE AS ONE OF THOSE IMPERIAL BUFFOONS OF HISTORY THAT ALWAYS PUZZLE US.”

Trend Following

Livingston favored investing in more prominent market trends. He sought the direction of more significant swings. Then he’d find how long would they last. He studied trends in trade publications. Some sectors fall quicker and more in a bear market. So, he chose carefully.

The USWTC Example

Livingston gave an example of his investment strategy. The U.S. World Trade Corporation (USWTC) had banks, steamship-lines, coffee farms and trolley-systems. It was into a huge export business. After WWI, its shares were stable and gave dividends. When the market fell, some stock groups sold their stocks. This pushed the prices further low. A rumor began that the firm wouldn’t give the next dividend. USWTC’s President denied the rumor in an interview. But, when the interview was published, the prices fell severely.

Within days, USTWC declared it wouldn’t pay a dividend. The firm’s President disagreed that the directors sold their shares short. He blamed political issues in the company’s key market in South America. These issues forced many clients to null their orders. Hence, USTWC directors were conserving cash and not paying a dividend. Livingston studied this case for three years. He shorted 10,000 stocks at 110. As the news built up, he kept on selling short until 30,000 shares were sold.

The share dropped into the 80s. As it kept on falling, the directors declared the missed dividend. Livingston finally covered his shorts when the stock was above 60. He looked at the factors impacting the business. Livingston had the same conclusion which the directors made. But, he made this conclusion weeks before they decided not to pay the dividend. Although the directors were wealthy bankers, they couldn’t beat the severe conditions. But, Livingston was in a position that he’d make money regardless of what they did.

“Ticker-Sense”

Livingston was skilled at buying and selling at right times. He came to understand the “behavior and time.” He was one of the best tape readers and analysts of his time. He could remember 20-year-old trades. His unique “ticker-sense” made him a natural share market winner.

He was excellent at mental math. During grammar school, he finished three years of math in one. When he was 13, he worked in a brokerage firm posting prices. This is how he learned to focus on how numbers changed. Through this, he built the skill of forecasting falls and rises. Livingston would note them in a book. He understood how some shares behaved when they fell or rose a few points. Then he’d check his forecasts against the actual tape. This didn’t provide any explanations for the price changes. But it did offer exact matches.

Livingston wasn’t a speculator. He just predicted probabilities. When Livingston was young and used tips, he also lost. For his first deal, he merged resources with a co-worker. They bought $5 worth of Burlington share. Its price rose, and they divided a profit of $3.12. He kept on buying and selling only on his forecast skills.

Beginning of Trading

Livingston left his job of posting prices by age 15. He was earning more by speculating. Livingston was trading since age 14. He had earned his first $1000 by age 15. And, he made his first $10,000 before he was 21.

Soon, he became so famous and successful that few bucket-shops didn’t take his money. He got the nickname “Kid Plunger.” So, he had to use a fake name for trading. He didn’t want the bucket shop owners to interfere. Hence, he knowingly placed losing trades. These were followed by huge profitable orders. He called this strategy a “sting” against the brokerage firms.

At 22, he shifted to New York with $2,500. Soon he was broke. His tape reading strategy wasn’t working in bigger brokerage houses. So, he borrowed $500, renewed his system and went to St. Louis. There, he traded in bucket shops. He fast made $2,800 in one shop before being known. Now, he was forced to go back to New York. He began trading again. One short-trade of $2,000 in a Hoboken shop gave him $5,100. After five years of his return to New York, did he make $1mn?

“ANY EXPLANATION EXCEPT THE TRUTH WILL DO TO ACCOUNT FOR THE OBVIOUS – WHEN THE OBVIOUS HAPPENS TO BE THAT THE CUSTOMER IS AN ASS.”

Why Individuals Lose Money

Trading isn’t an easy field. Wall Street has been home to several great people who couldn’t pick shares. Jay Gould paid $100,000/year in commissions. But, he only netted a $50,000 profit. J.P Morgan and his partners weren’t interested in stock-trading. Commodore Vanderbilt was one to buy and hold. James J. Hill was the most attractive person on Wall Street. E.H. Harriman was skilled at financial manipulations.

These great men were different from an average speculator who seeks easy money. When ordinary speculators come, they often lose money.

Common Mistakes

Below are the common errors these people make:

They do not have good motivation for speculating – They seek “something for nothing.” Their primary motivation is only greed or gambling.

They have lousy timing – There’s a time to earn money and to lose it. Buying a share too late is as bad as buying it too soon.

They do not think; they only hope – When non-experts buy shares, they wish them to go up. But, hope has got nothing to do with money-making. It’s human to make mistakes, but only fools repeat them.

They do not know what moves the markets – Normal people lose money because they don’t understand what drives the market. Livingston regularly read and hired experts for answers.

They lack experience – Livingston started trading at the age of 14. Hence, he saw various markets move.

They are ill-suited for speculation – Some people don’t have the mental or emotional ability to speculate. Livingston earned $1,000 at 15. He also filed bankruptcy in 1915 and owed a lot. But, within two years, he bounced back. And, two years post that he was again a multimillionaire.

“BROKERS DO NOT LISTEN TO ABSTRACTIONS. IF THEY DID SOME OF THEIR CUSTOMERS MIGHT MAKE MONEY.”

Market Lessons

As per Livingston, the following techniques helped him:

Sit tight – The market flows in two directions. Hence, many investors could be right. But, the key is to wait, sell and buy at the correct time. Investors knowing this timing are rare. But, they’re the ones to reap the maximum profits.

Be confident – To become an effective investor, trust your judgment.

Study general conditions – Huge money drives the main market trends. This dominates individual sales.

Trust your senses – Once, Livingston sold short 5,000 stocks of Union Pacific. He had no technical or primary reason. There was just a feeling that it would fall. Days after he began selling short, an earthquake hit SFO. This messed up the rail lines. Livingston made $250,000 on this trade. Then, the share started being stocked. Livingston observed this trend. So, he began buying. But, a manager at his firm advised him not to buy the stock. Weeks later, Union Pacific declared it would give a dividend. The stock went up. This cost Livingston $40,000.

Regardless of whether you’re buying or selling – be disciplined. If you’re bullish and purchasing, every new purchase must be higher than the last. This is “scaling up.” In contrast, you must make every sale at a lower price than the last. Livingston was famous for issuing sell and buy orders to check market strength.

Reminiscences of a Stock Operator Review

In the stock market, there are so many things to look at for the investors, and this book is a handful in this regard, as it reminds some of the previous experiences of traders and investors like Jesse Livermore. The author has written this book in the context of the great recession. The book is revolving around the story of Jesse Livermore, who was a great speculator of the stock market in the 1920’s. The author narrates the story filled with fear, greed, and jealousy that investors have in their behavior. The book provides great insight for the Livermore’s life that how he started his trading work and accomplished so much success with his great speculations. It is revealed that when the market is full of sellers or when selling is stopped, then the fall of the market is an expected outcome. Livermore started day trading at the age of 15, and he was able to earn money at such a young age due to his great speculation abilities.

The book also reveals that why investors lose their money in the stock market. They lose money because they make wrong speculations & judgments, and when the timing is critical, they miss that proper timing and invest during the bad time. The story of Livermore suggests that an investor and trader have to be patient as well as confident in his abilities. He/she should trust his/her ability to make speculations. Livermore was a great stock operator in this regard. He had confidence in his abilities and never feared to make risky decisions. Some of the decisions paid back, and some of them did go wrong, but this is how Livermore got fame, success, and failure in his life. But trading secrets revealed by the experiences of Livermore can be great for investors of today. The book is a good one for investors to understand that why investors lose money, and how they can avoid doing so by following some common and useful habits.

Reminiscences of a Stock Operator Quotes

“My own opinion is that Livingston will agree with me that stock speculation is an unbeatable game.”

“A picturesque figure, this breezy buccaneer of boodle, flamboyantly theatrical, incredible as one of those imperial buffoons of history that always puzzle us.”

“Any explanation except the truth will do to account for the obvious – when the obvious happens to be that the customer is an asset.”

“Brokers do not listen to abstractions. If they did some of their customers might make money.”

“If the unbeatable game of stock speculation had not been beaten by this man it at least had received a severe jolt at his hands.”

“The man who does big things is less afraid of being blamed than of being misunderstood.”

“Prices either were going the way I doped them out, without any help from friends or partners, or they were going the other way, and nobody could stop them out of kindness to me.”

“I did precisely the wrong thing. The cotton showed me a loss and I kept it. The wheat showed me a profit and I sold it out. Of all the speculative blunders there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit.”

“Another lesson I learned early is that there is nothing new on Wall Street.”

“The game taught me the game.”

“Whatever happens in the stock market today has happened before and will happen again.”

“You cannot prevent some people from guessing wrong, no matter how able or how experienced they may be, because every man has many enemies within himself as well as on the outside.”

AUTHOR

ANKIT VERMA

ASSISTANT PROFESSOR

Comments

Post a Comment