THE INTELLIGENT INVESTOR BY BENJAMIN GRAHAM SUMMARY

Benjamin Graham was one of the greatest practical investment thinkers of all time. After his widowed mother lost all of their money in the financial crash of 1907, his family fell into poverty. Yet, Graham turned this around. Studying at Columbia University, he went on to work at Wall Street, going from clerk to analyst to partner before running his own investment partnership. Consequently, he amassed a wealth of historical and psychological knowledge concerning the financial markets, that spanned several decades. And he shared that knowledge in his book, The Intelligent Investor.

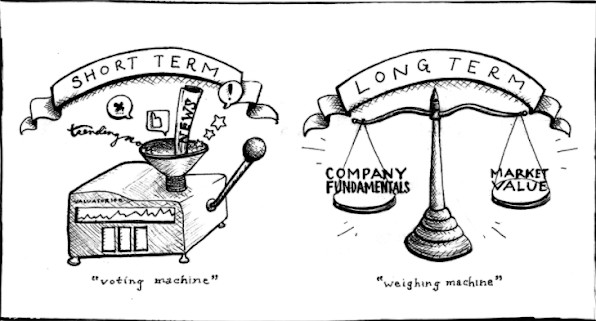

In ‘The Intelligent Investor,’ little time is spent discussing the technique of analyzing securities. Instead, great focus is placed on investment principles and investors’ attitudes. Although ‘The Intelligent Investor’ was first published in 1949, the underlying principles of good investment do not change from decade to decade. Consequently, in ‘The Intelligent Investor,’ Benjamin Graham aims to teach us three things:

1. How to minimize the chances of suffering irreversible losses.

2. How to maximize the chance of achieving sustainable wins.

3. How to overcome self-defeating modes of thought that often prevent investors from reaching their full potential.

To be an intelligent investor, you must be patient, disciplined, and eager to learn new things. You must also be able to control your emotions and to think for yourself. Graham states that the intelligence needed to be a good investor has much more to do with character than it does IQ. Throughout this ‘The Intelligent Investor’ summary, we shall explore some of the key investment takeaways, and the Benjamin Graham formula for smart, successful investing.

AUTHOR

ANKIT VERMA

ASSITANT PROFESSOR

Comments

Post a Comment