When Genius Failed By Roger Lowenstein

Learnings from LTCM Downfall (When Genius Failed)

1) Leverage Kills:

Leverage seems exciting at the start as it turns overall mediocre returns on investments into formidable returns on equity. However, investors frequently forget that leverage is a double-edged sword. It pushes the return on equity during upside; however, it hammers down the same return on equity during downside.

Many investors in the initial euphoria forget this basic premise and invest in derivatives like futures & options. LTCM managers learned the effects of leverage by paying up with their careers, social positions apart from personal investments in LTCM. Common investors also many times suffer heavy losses in derivatives.

Investors should always avoid leverage while investing. Warren Buffett does not call derivatives “Weapons of Mass Destruction” without reason. Warren has always advised Berkshire Hathaway shareholders and investor around the world to avoid borrowing for investing. In his 2014 letter, Warren writes:

“Another warning: Berkshire shares should not be purchased with borrowed money. There have been three times since 1965 when our stock has fallen about 50% from its high point. Someday, something close to this kind of drop will happen again, and no one knows when. Berkshire will almost certainly be a satisfactory holding for investors. But it could well be a disastrous choice for speculators employing leverage.”

“Indeed, borrowed money has no place in the investor’s tool kit”

2) Diversification does not help in crisis. Everything falls down simultaneously.

It is widely known belief that diversified portfolios provide cushion during bad times as it is highly unlikely that all the different investments will go down in value simultaneously. However, repeatedly, it has been proved that during a crisis, all the investment assets lose value together. It happened in 1987, repeated in 1998, again in 2000-02 and then in 2008. During such times, all the stocks go down together.

LTCM learned it the hard way that the statistical proofs of decreasing standard deviation by increasing the number of investments in a portfolio works best only in computer models. In real markets, the people decide prices and when crisis strikes, it creates panic. During panic, investors lose rationality and everyone runs to safety by dumping every asset they own. Cash becomes the safest investment and everything else including stocks, bonds or real estate is discarded. Result is wide spread fall in prices of all asset classes. No wonder, all 60-70 assets of LTCM lost money together.

Successful investors have always considered diversification with a pinch of salt. Warren Buffett wrote to shareholders in his 1978 letter:

“Our policy is to concentrate holdings. We try to avoid buying a little of this or that when we are only lukewarm about the business or its price. When we are convinced as to attractiveness, we believe in buying worthwhile amounts.”

Therefore, it is advised that investors should not overemphasize on diversification and keep the number of stocks in their portfolio limited.

3) Investing is not pure science. It requires common sense. (When Genius Failed):

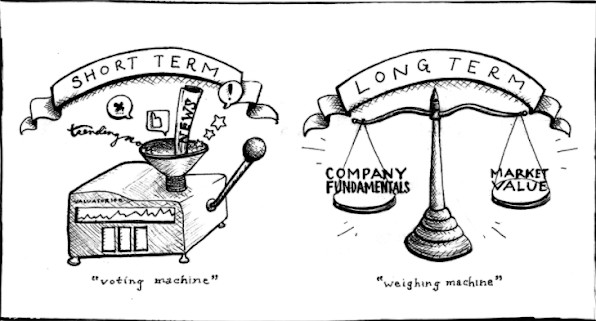

LTCM assumed markets to be science and mathematics. Their managers believed to predict markets using computer models. However, investing is dealing with assets & companies managed by humans.

People run companies but somehow this fact is forgotten by investors. Many investors start assuming companies as mathematical models where a fixed amount of investment in assets or R&D would bring a fixed amount of return. People differ in performance day in and day out. Companies show vastly varying performances, many times for no apparent reasons.

People decide the prices in the markets. People have emotions and they become euphoric and panic at unpredictable times. These behaviors take asset prices over the peaks and then down in troughs. Mathematical models cannot predict the timing of such periods and therefore, they should not replace human judgment.

Investing is more of an art where once the basic financial numbers are obtained; rest is dependent upon the investor’s subjective judgment and common sense.

4) Intelligence (IQ) cannot guarantee good returns in markets.

An investor does not need to have an IQ of 150 to succeed in stock markets. If intelligence had a correlation with the results in stock investing, then LTCM, which had some of the most intelligent people alive on earth, could never have failed.

All the mathematics that an investor needs while analyzing stocks is the basics taught in school. Rest is her own judgment, experience, common sense and gut to take decisions. Every one whether you or me, whether having finance background or not, has equal chances of doing good in stock markets provided one is willing to put in the required time & effort to read and analyze stocks.

5) Institutional investors are not always right. Seemingly smart money does act dumb many times.

Many investors try to mimic the investment decision of large institutional investors or FIIs or famous high net worth investors. LTCM episode is a glaring proof that no one is above errors. Investors who follow others do so at their own peril.

It is advised that investors should invest in stocks only after doing their own research. Peter Lynch, in one of the best books on investing “One up on the Wall Street”, says that investing in stocks without doing own research is like playing poker without looking at your own cards.

6) Markets are irrational or we should say are not purely rational. (When Genius Failed):

One of the most popular theories prevalent today is that markets are efficient. Efficient Market Theory suggests that all the participants in the market have same amount of information and they all react to the presented information in the same highly rational manner. However, any investor who has an experience of few years of investing or observing or analyzing stocks, would say that markets are not always rational. Stock prices move to extremes as market participants overreact to both good and bad news.

Charlie Munger says that Efficient Market Theory was devised by so-called experts, mathematicians who wanted to apply their knowledge to markets and therefore devised the assumptions, which let them apply their theories to market prices. Efficient Market Theory formed a perfect platform for such application of mathematics as happened in case of LTCM.

LTCM managers assumed that markets are rational and whenever any change occurs, all the market participants would react in most rational manner and bring the prices to new rational level, which could be predicted by computer models.

The fall of LTCM provides another proof that markets are made of emotional human beings, who act irrational all the time. Market prices do not always reflect the rational levels and therefore, provide many opportunities for keen value investors to achieve good returns.

7) Markets can stay irrational longer than you can remain solvent. And

8) Put only that much money into markets, which you can afford to lose without going bankrupt.

Stock markets are irrational and would always provide the investor with opportunities of investing in stocks, which are available at a discount to their actual value. Such opportunities present excellent wealth generating avenues. However, markets may not recognize the aberration in pricing of these stocks immediately after an investor buys them. Moreover, there may be many months or years before a good performing company with cheap share price is recognized by other market participants and its price increases in value.

Markets are known to test the patience of investors with very long periods of inactivity. Such periods creates feelings of frustration and self-doubt in investors and many times, makes them take wrong decisions exact at precisely wrong times.

Stock markets require patient capital and staying power. LTCM with its huge equity of USD 4.6 billion could not remain solvent during the time taken by markets to return to rational levels. The same can happen to individual stock investors as well. It is therefore, advised that an investor should have an emergency fund and save money for other critical life decisions before she decides about investing in stock markets.

9) Never invest in stocks of your employer. You may lose your job and savings together.

Most of the employees of LTCM invested their savings and bonuses in the LTCM fund itself. They were happy to get an opportunity to invest in a fund, which had stopped taking investors’ money. They were happy to see their personal net-worth grow initially, but got the shock of their lives when their job and savings vanished simultaneously.

LTCM episode cautions salaried investors while investing in stocks of their employers just like previous episodes of Enron and WorldCom did.

Key learning from “When Genius Failed”

1. Leverage kills.

2. Diversification does not help in crisis. Everything falls down simultaneously.

3. Investing is not pure science. It requires common sense.

4. Intelligence (IQ) cannot guarantee good returns in markets.

5. Institutional investors are not always right. Seemingly smart money does act dumb many times.

6. Markets are irrational or we should say are not purely rational.

7. Markets can stay irrational longer than you can remain solvent.

8. Put only that much money into markets, which you can afford to lose without going bankrupt.

9. Never invest in stocks of your employer. You may lose your job and savings together.

This ends the current article about the learning from the fall of the most revered hedge fund of all times “Long Term Capital Management”. I suggest that every stock market investor should read about the story of LTCM, its rise, its fall and the learning from its experiences.

The book “When Genius Failed” is a nice and simple read about the life of LTCM and should be a source of great learning lessons for every investor.

AUTHOR

ANKIT VERMA

ASSISTANT PROFESSOR

Comments

Post a Comment