The Money Book for the Young, Fabulous & Broke By Suze Orman

The book is organized by chapters that correlate to important money issues:

1. Know the Score

Orman says that the most important thing twenty- and thirty-something-year-olds can do for their financial future is to know and improve their credit score. She thoroughly explains what the FICO score is comprised of, how to improve it, how to run a credit score report, how to fix errors, and how your credit score can affect your financial future.

2. Career Moves

Orman’s advice in this chapter is sometimes surprising. She advocates that you find a job you love, and not just work for the money. She even advocates using credit cards for a few years to supplement your income if you have a job you love but that does not pay much in the beginning. Orman doesn’t advise that you finance an expensive lifestyle, but rather that you use credit to help survive by meeting basic needs until your career pays enough to support you completely.

3. Give Yourself Credit

Because Orman advocates that young people use their credit cards for basic living expenses if their jobs do not pay them enough, she uses this chapter to give advice on how to limit your expenses with credit cards, such as by finding low interest cards with no annual fees. She also explains how to avoid getting behind on credit card payments.

4. Making the Grade on Student Debt

Student loan debt plagues millions of college graduates, and Suze Orman offers encouragement that the student loans are likely to be worthwhile as the incomes of those who carry them climb over the years thanks to their higher education degrees. She also offers specific ways to both cope with student loan payments and lower the interest rate.

5. Save Up

In this chapter, Orman offers specific techniques to find more money in your budget and begin to save. For instance, she doesn’t say to stop going to the bar altogether, but instead suggests that you make better decisions, such as buying a beer or a glass of wine instead of a $10 martini, or even going to a cheaper bar. Other techniques include checking your credit card statement monthly for errors.

6. Retirement Rules

Trying to tell most new college graduates who may be deep in credit card and student loan debt to save for retirement is a hard sell, but Orman offers a compelling argument. For example, if someone who is 25 invests $300 a month for 15 years (a $54,000 investment) and earns an 8% return in a retirement account – and then doesn’t invest any more after that – he or she will have $1.05 million by the age of 70. Orman explains the various retirement vehicles that are available, and which one to invest in first.

7. Investing Made Easy

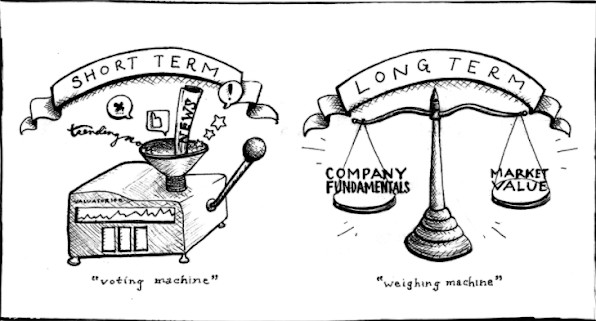

Explaining the principles of investing in one chapter is not easy, but Orman provides a basic primer of the stock market and mutual funds, explaining specific terms such as load or no load, and small and large cap funds. In addition, she gives a short synopsis of the best choice for allocating funds in your 401k or Roth IRA.

8. Big-Ticket Purchase: Car

Orman immediately argues against leasing a car, providing mathematical data to prove why leasing is not a good investment. She would prefer that people in their twenties buy used cars, but she also has strategies for those who want to buy new. She outlines the best way to deal with car salespeople, and the financial implications your choice of a car has on numerous aspects, such as insurance.

9. Big-Ticket Purchase: Home

In the last 5 to 10 years, many financially unprepared people have jumped into home ownership, and they have suffered the consequences. While Orman does not suggest that you have to be completely debt-free before purchasing a home, she does insist that your debts be on the decline, and that you have at least 3% available for the down payment (though she would prefer 20%).

This is one of the most thorough chapters in the book. She clearly outlines all the fees and expenses that come with home ownership that many people do not consider, such as closing costs, maintenance, property taxes, and insurance, which can make a home payment that seems within your budget suddenly several hundred dollars out of reach.

10. Love & Money

Many people get married in their twenties and thirties, so Orman ends the book with this chapter. While the chapter includes practical advice, such as whether to have a prenuptial agreement and what kind of life insurance to purchase, she also stresses that you should carefully pick your partner, because when you marry someone, you are marrying their finances and their financial behavior. This can affect you positively or negatively throughout the duration of your marriage.

AUTHOR

ANKIT VERMA

ASSISTANT PROFESSOR

Nice concept

ReplyDelete