The theory of investment value By John Burr Williams

The Theory of Investment Value by John Burr Williams is a classic, and was referenced by Warren Buffett in his 1992 annual shareholder letter as “the equation for value”.

This post will present and explain this exact formula published by John Burr Williams and help modernize it in today’s terms. Nobody has done it better than Warren Buffett himself, and so I recommend reading his 1992 letter for yourself for additional insight.

The equation for (intrinsic) value that eventually came to form the basis for modern DCF valuation is admittedly difficult to model even when reading the John Burr Williams classic, so I’ll have to explain some of the Greek symbols he presents in the final equation, which are scattered throughout the book.

Keep in mind that some of these Greek terms won’t necessarily correlate to the general terms used in regular algebra.

Capital Vo (on the left of the equation) is defined as the investment value per share (page 76), which is what we are trying to solve here

π (pi) is used to by Williams to signal dividends paid (also p.76)

The subscript is used to indicate the year a dividend is paid

The lower case “o” in this case indicates a dividend paid in the initial year examined

ω (omega) is defined by Williams as lower case “u” times lower case “v”

ω = uv

Found on page 88

Breaking down ω = uv

u = 1 + g (sourced from page 87)

g = annual growth of dividend paying power

So, all of this fancy notations for ω (omega) comes down to a relationship between dividend growth and the interest rate. Value to the investor comes from dividend growth, which when equated to modern DCF terms, refers to the growth of free cash flows, which is usually modeled by a mathematical summation in most finance textbooks (the upper case Greek symbol sigma: Σ).

Keep in mind that ω (omega) here is scattered throughout the final equation, and will be summed eventually to represent each year of cash flows being discounted (more on this later).

As lower cases u and v are defined already in the notations of ω (omega), we now have a definition for all of the terms used by John Burr Williams in the equation for intrinsic value.

Last word of note here:

lower case “n” is number of years dividends are paid

You’ll notice that John Burr Williams uses dividends in all of his formulas in the book, to assist in determining intrinsic value. Modern analysts have replaced most intrinsic value formulas to use free cash flows instead of dividends, partly because:

Dividends come from free cash flows

Free cash flows reinvested at higher rates of return can create exponentially higher future FCF and dividends

Dividend yields have gradually decreased for decades now, adding to the perception that returns now come mostly from capital appreciation rather than dividends

Among other factors…

Models such as the Dividend Discount Model are still used to evaluate some businesses such as banks and financials, whose dividends are generally more stable. However, this distinction is one of the few divergences between what Williams wrote his book and what is widely used in finance today.

Simplifying the John Burr Williams Formula

By plugging these definitions in and making some algebraic simplifications, we can hopefully manipulate the equation to understand it in modern terms and relate it to today’s Discounted Cash Flow Models (DCFs).

From this simplification, we can see an obvious parallel to the modern DCF. The “g” in growth of dividends is similar to a growth in free cash flow, and the “i” in the denominator represents the WACC, or discount rate, that an analyst is using to discount cash flows.

This whole first group of multiplication is used to determine the present value of cash flows, which is taught by Damodaran, McKinsey and Co, and others as the first stage of a DCF.

The second group (below) attempts to formulate a figure for the continuing value, or the discounted value of cash flows once the company reaches a steady state of growth.

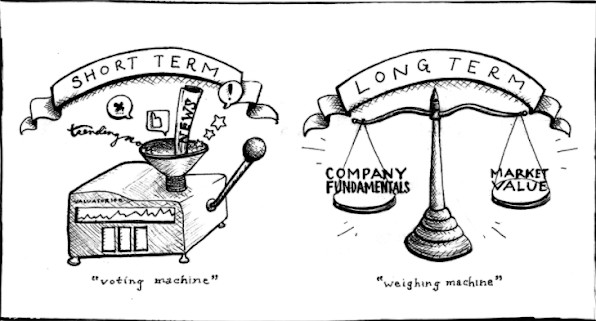

Burr Williams also graphically defined this phenomenon, where a company/ industry experiences a rapid growth stage followed by a slowing in a mature state, with growth eventually approaching an upper limit (or perhaps just evenly matching GDP).

He also explicitly defines an important caveat with the entire discounted cash flow process on page 89, which nicely summarizes the theory behind how the relationship between ROIC and WACC can increase value or destroy value.

By going back to that ω (omega) simplification again, you can see that if i > g, then ω (omega) returns a negative value, and leads to the ending Vo to be finite, and if continued, to become zero. If ω (omega) is equal to one, or greater than 1, the mathematical value of Vo will be infinite, which of course is impossible in real life—which is why a continuing, or “terminal”, value is established as the final stage of the equation.

The Best Summary by the Author Himself

I realize that this is all a lot to take in, and I recommend learning the basics of a DCF valuation and working through some examples before you try and decipher the John Burr Williams equation—as it’s a bit more complex and hardly used directly today.

However, the lessons behind this book and its teachings are truly timeless, as the principles established throughout are still largely in practice and widely observed today.

I’ll leave you with a fantastic quote from the book that Williams wrote, which really summarizes how anyone’s approach to finding intrinsic value should be:

“Any other function that lends itself to convenient mathematical treatment may be used, so long as the general premise that stocks derive their value from their future dividends is adhered to”.

And about what it takes to be a great analyst:

“Economic facts, interpreted with his [the student of investment] best judgment, must tell him what the probable curve of a company’s growth is, and how far along the curve the company has progressed.”

AUTHOR

ANKIT VERMA

ASSISTANT PROFESSOR

Comments

Post a Comment