THE MILLIONAIRE NEXT DOOR BY THOMAS J STANLEY SUMMARY

THE BIG TAKEAWAYS:

1. Not every millionaire just throws their money away.

i. If Many millionaires maintain their status through careful maintenance of their money.

2. An authentic millionaire believes that being able to live freely has more power than everyone knowing how much money they have.

i. It’s a common misconception that millionaires love to flaunt their wealth, whereas many true millionaires appreciate their financial freedom over the material things.

3. Millionaires know where their money is worth the most.

i. Smart buying and smart investment are a skillset many millionaires possess.

4. Millionaires give their kids what they want, even if it poses a threat to their future.

i. It is not uncommon for millionaires to support their children into adulthood, where it becomes more hurtful than helpful.

5. The children who achieve more understanding of the way money works in the real world tend to receive more money from their parents.

i. The children of millionaires that prove the most financially literate tend to receive more inheritance.

Living Well Below your Means

It is a myth that millionaires drive fancy cars, live in huge mansions in ultra-rich neighborhoods and wear designer clothes. Frugality was found to be a crucial foundation of wealth-building. The authors share the 4 common practices of wealthy households, and how the millionaires play offense with income-generation, and play defense with their spending.

Using Time, Energy and Money Efficiently

Time, energy, and money are finite resources, and wealthy people channel these resources efficiently to build wealth. They start earning and investing as early as possible in their adult life. Read more from the book or book summary on how the PAWs plan and manage their finances carefully, tracking their expenses closely and minimizing their “realized income” to reduce taxes.

Financial Independence, Not Wealth Artifacts

Wealthy people prioritize achieving financial independence over displaying a high social status. Find out from the book why staying in a prime neighborhood or owning a luxury car sets you back in your wealth accumulation. Being financially-prudent also doesn’t mean being miserable – Most PAWs love what they do and how they live; despite their simple lifestyles, these financially independent people are actually happier than their UAW counterparts with a high-consumption lifestyle but no financial security.

No “Parental Economic Support”

It is common for parents and grandparents to offer economic gifts and “acts of kindness”, such as paying for the children or grandchildren’s private school tuition fees, or home mortgages. The authors caution against such handouts, and share their advice on the best ways to offer these gifts without inculcating poor financial habits.

Nurture Self-sufficient Adult Children

Most affluent, well-informed parents would want to progressively reduce the size of their estate before they pass away, so they can share the wealth with their children without leaving them with a huge estate tax liability.

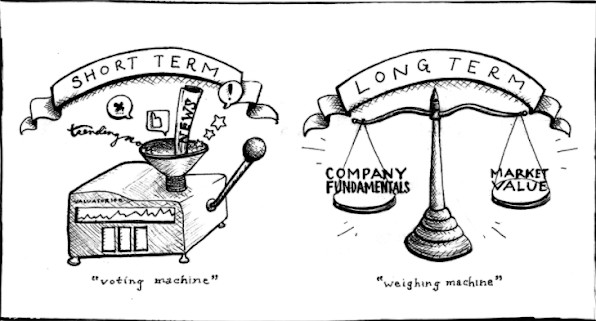

Leverage Market Opportunities

The affluent surveyed in this book – especially the self-made ones – accumulate wealth because they actively target and pursue market opportunities. Read more to find out what are some of the opportunities you should look out for.

Choose the Right Vocation

Most of the affluent in America are business owners, including self-employed professionals. Yet, less than 20% of these successful business owners pass their businesses to their children, and many even advise their children against business. While there was no clear predictor of which types of business generated more millionaires, most of the affluent business owners interviewed were in “dull” but stable businesses.

AUTHOR

ANKIT VERMA

ASSITANT PROFESSOR

Comments

Post a Comment